What does it take to turn the final stretch into a competitive edge? For Aramex, the answer was last-mile delivery digital transformation.

125 million shipments a year. That’s the scale Aramex was moving at, and with that kind of volume, every delivery becomes a promise you’re expected to keep. Customers want speed, visibility, and control. Drivers need flexibility, integrity and support.

Founded in Amman, Jordan, and backed by over 18,000 employees and $1.6 billion in revenue, the company was expanding into new markets at full throttle. But their internal systems weren’t built for this kind of pressure. Operations were getting more complex. Courier demand was rising. And a new wave of digital-first customers wanted to track their deliveries in real time, make changes on the fly, and feel in control every step of the way. Aramex had the ambition to push their last-mile delivery digital transformation strategy forward.

Two things became clear: they needed more hands on the road and smarter ways to drop off packages. Aramex had to move fast, roll out across multiple regions, and find a way to give both their workforce and their customers the digital tools they needed. The last mile had to evolve into something smarter, leaner, and ready to grow. The pressure was on with tight timelines and high expectations.

Scaling up: The right partner and strategy

With clear direction and expectations, they started looking for the right crew to help them stay ahead. They trusted us to simplify their lives with 2 multi-persona crowdsourcing platforms that could keep up with their speed and scale.

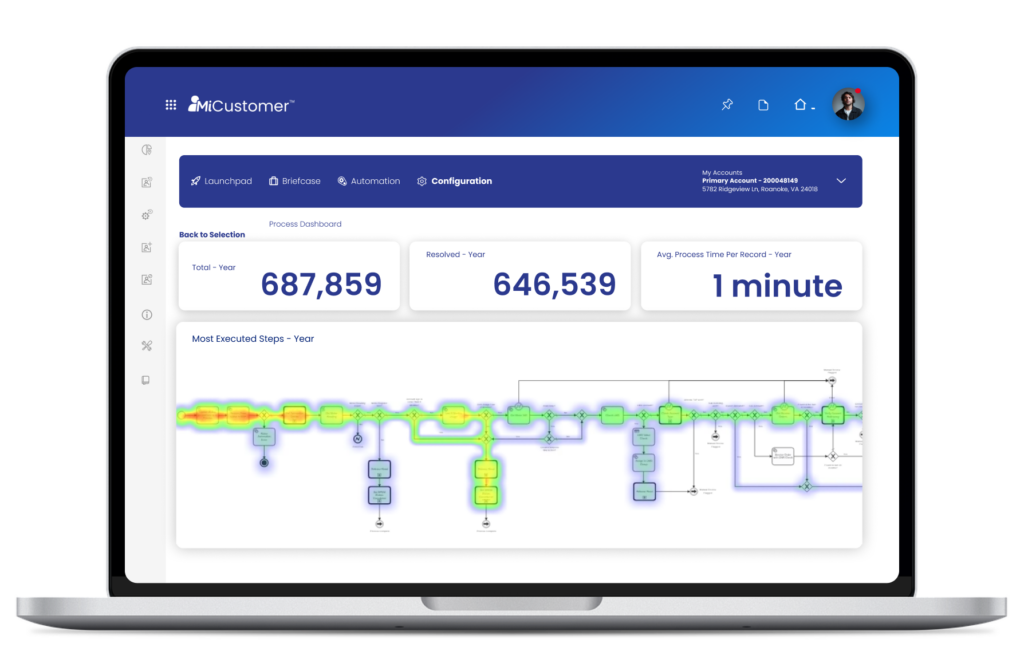

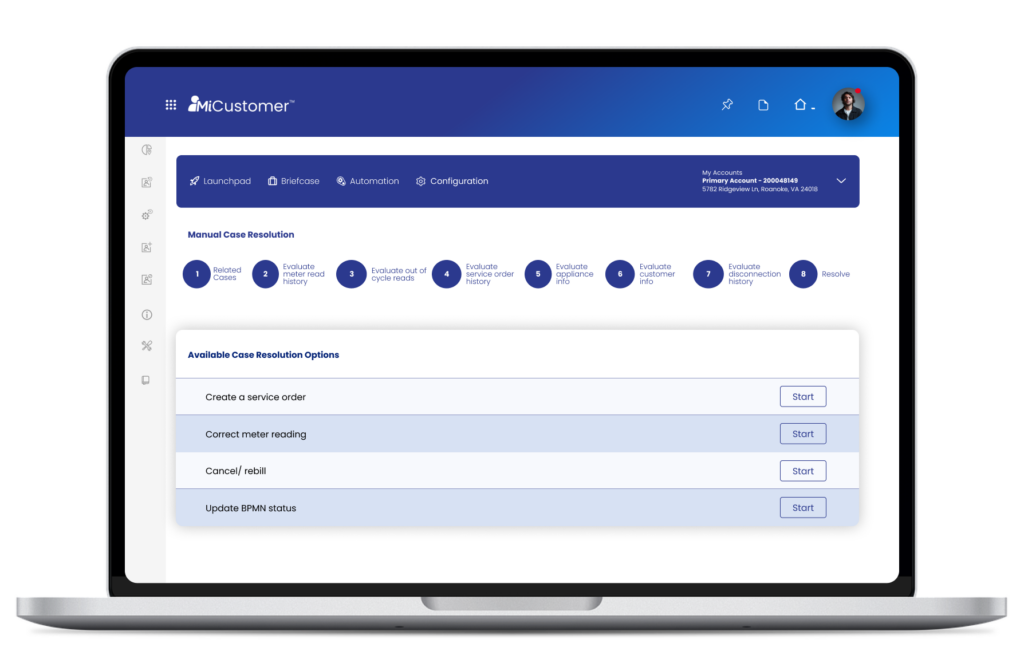

As accredited Mendix partners, we brought in the Mendix low-code platform to power the digital transformation. Using Mendix’s flexibility, we accelerated development with MiCustomer (DXP), our modular digital experience platform. Instead of starting from scratch, MiCustomer allowed us to reuse features, speeding up development and ensuring consistency across both platforms.

From the start, we collaborated with Aramex to design every journey around real roles and day-to-day interactions. We built an intuitive admin portal and a Know Your Driver experience to provide an end-to-end view of personal, vehicle and payment setup for fleeters, integrating with SAP through the Mendix OData adapter and SOAP services, making the platforms responsive, scalable, and fully connected.

The UI was designed to reflect Aramex’s brand and simplify the experience for users at every level. Custom widgets and consistent components kept everything easy to navigate.

Our last-mile delivery digital transformation strategy focuses on leveraging lean, tech-driven models such as ‘Aramex Fleet’ to tackle capacity constraints and enhance last mile delivery.

– Khalid Jamjoum, Head of Global Capacity Planning and Last Mile Innovation at Aramex

Now let’s take a closer look at what Fleet and Spot really meant for Aramex, and how they reshaped daily operations.

Fleet: Building on-demand driver networks for smarter logistics

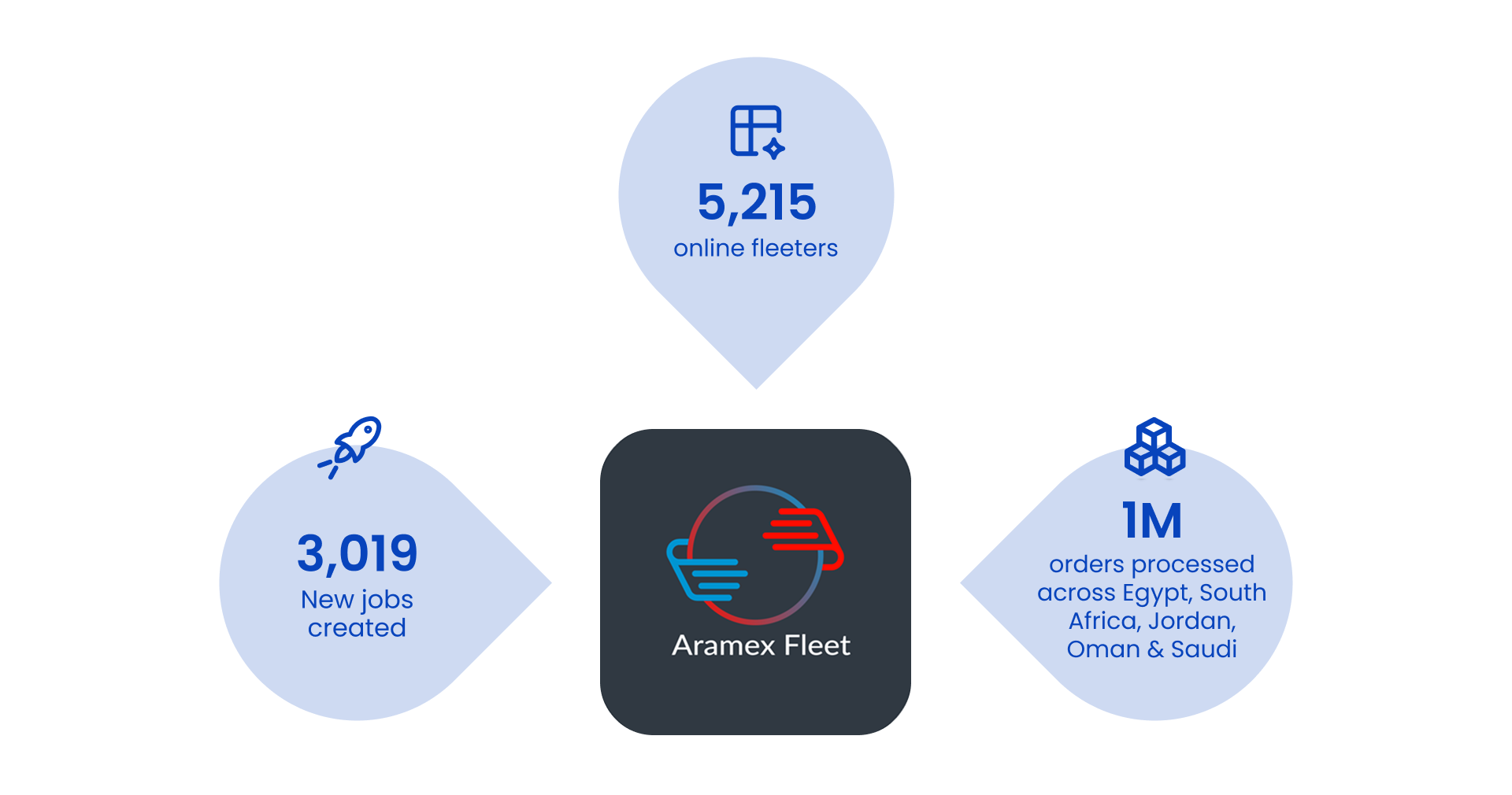

Fleet marked the beginning of Aramex’s last-mile delivery digital transformation, built in under eight weeks. The platform was designed to recruit, assign, track, and pay independent drivers. Through the app, drivers could register, choose when and where they wanted to work, and get matched with nearby deliveries. At the same time, customers gained real-time visibility into their shipments, with full self-service access through their accounts.

This flexibility created real operational value. Aramex could scale deliveries up or down based on demand, reduce idle fleet time, and expand coverage without increasing fixed costs. It also opened the door for locals to earn income on their own terms — helping Aramex meet demand while empowering communities.

Over time, Fleet became an impactful and central part of day-to-day logistics, making delivery faster, more efficient, and more responsive to both business needs and customer expectations.

Spot: Expanding last-mile delivery with local pickup and drop-off hubs

Capitalizing on the 14 weeks saved during the Fleet project, Spot quickly followed suit: a platform designed to be the key to Fleet’s lock. Spot created a network of local pickup and drop-off points, allowing drivers and customers to store packages temporarily, whether overnight or longer, providing them with more flexibility.

The efficiency of our low-code services for logistics played a significant role in making this possible. By leveraging the same APIs and functionalities developed for Fleet, the team built Spot quickly and efficiently. This reusability allowed them to skip much of the groundwork, saving time and ensuring the platform launched without compromising on quality.

Both platforms spoke to one another. When a package arrives at a Spot location, fleeters are instantly notified, enabling them to pick up the package along their route, reducing unnecessary trips to the warehouse. This seamless connection between the platforms not only improved delivery efficiency but also reduced operational costs, such as fuel and wear-and-tear on vehicles.

Spot also improved the customer experience, offering more convenience by providing additional delivery points closer to customers’ locations. It brought value to local businesses as well, who were able to become part of the delivery ecosystem by hosting Spot locations.

Today, with over 150 Spot locations in Saudi Arabia and 600 more shops eager to participate, Spot continues to grow. Looking to the future, Aramex and avertra are collaborating on a five-year roadmap that will scale across 40 countries, supporting 75,000 drivers and automating the processing of 50 million orders annually. Thanks to our low-code services for logistics: both Fleet and Spot are now part of a larger vision to drive efficiency and redefine the future of last-mile delivery.

Simplifying tomorrow, today: low-code digital transformation for every industry

Digital transformation is key to efficiency and scalability. Our low-code solutions helped Aramex combat capacity limitations and drive the growth of eCommerce through innovations in last-mile delivery. We also empower highly regulated industries like healthcare, finance, and utilities to streamline operations, cut costs, and elevate customer experiences.

Curious how low-code can bring change to your business?

Book a free consultation today to discover how avertra’s low-code services can drive your business forward.