NTUA saw the same pattern each day as customers waited on long calls for tasks that could live inside a self service portal. That clarity shaped the path for their digital transformation.

A community connected

Across the 26,000 square miles of the Navajo Nation, NTUA provides electricity, water, natural gas, wastewater services, and solar power to families and businesses that rely on steady support for daily life. The region spans northern Arizona, northwestern New Mexico, and southeastern Utah, shaping routines with essential services that carry deep importance.

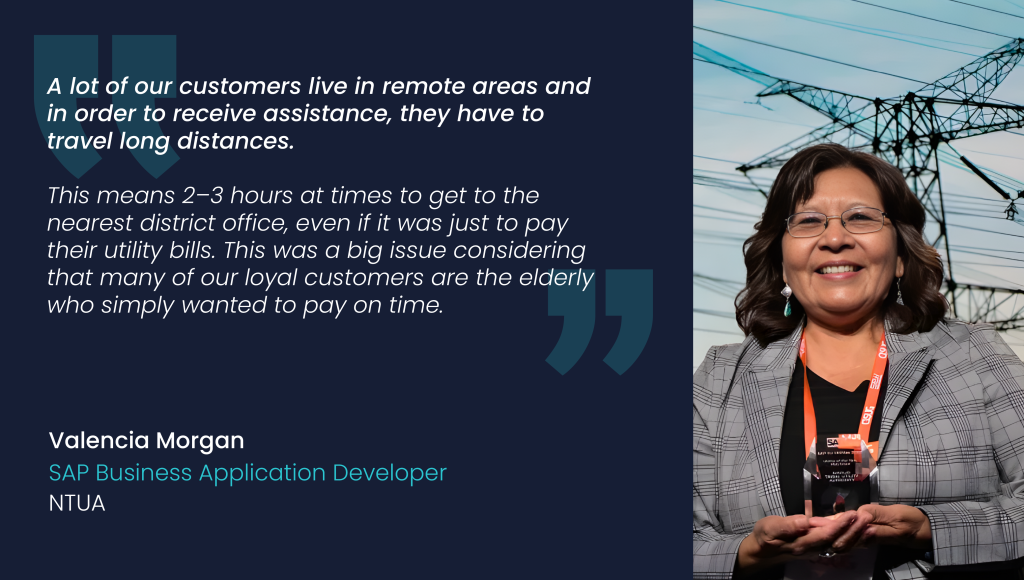

Many households live far from district offices. Even simple requests required long travel or extended wait times. NTUA recognized the need to create stable digital access that brought these daily tasks closer to home. This understanding guided the decision to build a self service portal that supported customers with clarity and consistency.

Life before the portal

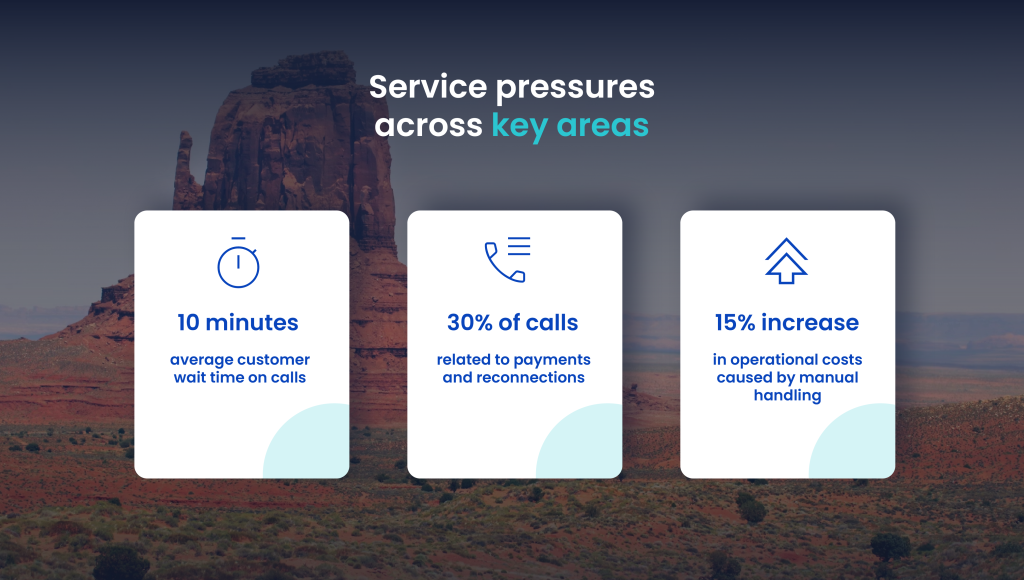

Customers faced steady friction across basic interactions. For a customer base largely composed of elders, the physical distance to offices was a significant barrier. Call volumes rose as families sought help with payments, usage information, and service needs. Employees relied on old paper systems and manual steps that limited visibility and created pressure across the contact center.

These experiences shaped the need for a digital environment that simplified daily responsibilities for both customers and employees.

A promise to serve

NTUA approached this effort with the intention to uplift families through accessible, intuitive digital tools. avertra aligned with this vision through a commitment to Simplify Life and deliver experiences shaped by clarity, empathy, and thoughtful design. Together, our teams focused on building pathways that supported community needs with calm, guided steps.

The first step into digital transformation

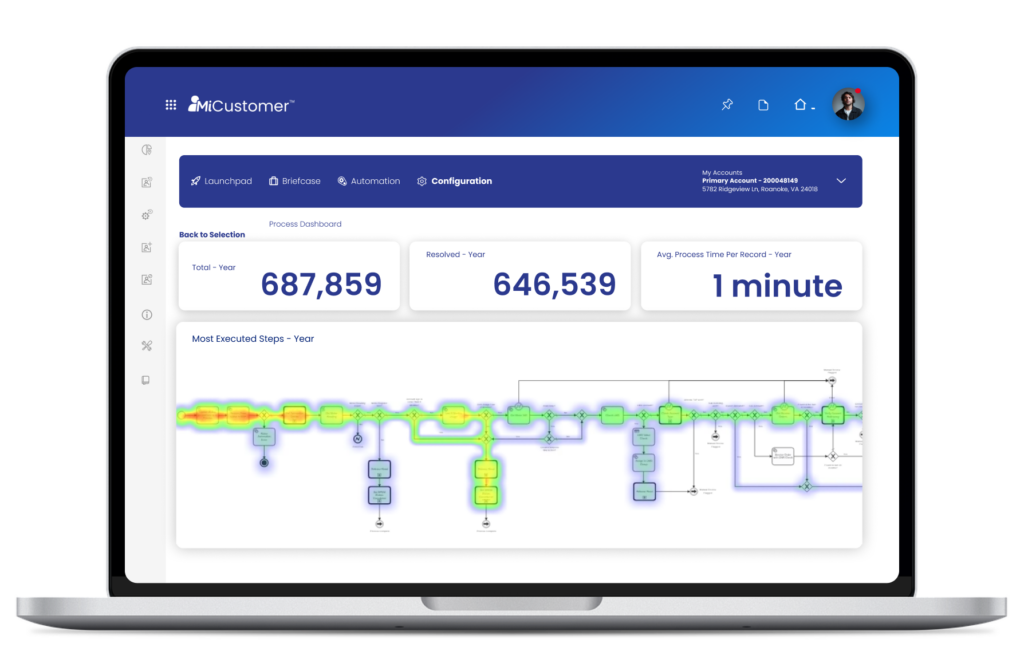

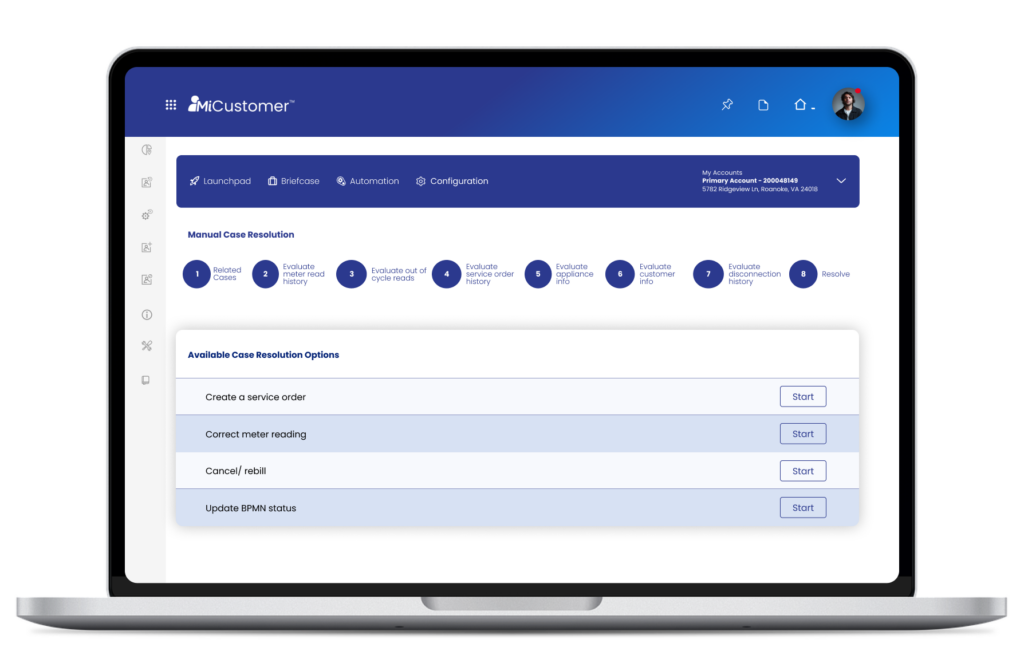

NTUA introduced its first-ever self service portal through MiCustomer DXP. The platform offered a unified view of accounts, usage, payment options, and essential tasks. Customers gained organized pathways that encouraged independence and reduced reliance on the contact center.

MiCustomer blended technical precision with a human-centered philosophy. Customers moved through key steps with confidence. Employees gained a consistent omnichannel environment that improved visibility and supported smoother coordination across the organization. This foundation prepared NTUA for deeper enhancements and long-term digital growth.

Impact of the digital transformation

The self service portal delivered immediate operational value. Families used digital tools to complete essential tasks on their own time. Employees gained back hours to support conversations that required personal attention and better strategic output.

Expanding digital access across the Navajo Nation

Building on early success, NTUA focused on moments that consistently pulled customers back into long calls and in-person visits. Installment plans, payment deferrals, and reconnection requests carried urgency and stress, especially for families managing tight timelines and long distances. These requests needed clarity, speed, and reassurance. Through MiCustomer, NTUA introduced guided digital pathways that allowed customers to complete each step on their own terms. Automated flows, clear instructions, and third-party integrations reduced uncertainty, while a structured work queue ensured requests needing manual review were handled with care.

This insight guided the next phase of NTUA’s digital experience.

Families embraced these tools quickly. Each digital interaction was a relief from long travel, reduced hold times, and a clearer process for every important financial decision. Employees followed organized digital footprints that supported timely action and consistent progress across departments. Within months, NTUA was able to resolve:

This adoption highlighted the value of accessible digital services for utilities serving large rural regions and reinforced NTUA’s direction for continued digital expansion.

A foundation ready for tomorrow

NTUA now stands on a digital foundation shaped by real experiences and real needs. MiCustomer supports continued growth through tools that adapt as the community evolves, without adding complexity or distance. The self service portal gives families a dependable place to manage essential services in moments that matter, with clarity they can trust.

This work reflects a shared responsibility to show up for the Navajo Nation with care, consistency, and respect for daily realities.

Learn how MiCustomer DXP creates self service experiences that support every community

Book a free consultation and begin your own transformation.